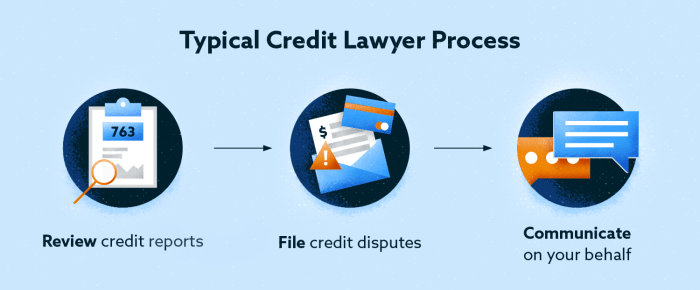

Credit lawyer, a term that often evokes images of complex legal battles and financial woes, is actually a vital resource for individuals and businesses alike. Navigating the intricate world of credit law can be daunting, with its myriad regulations, contracts, and potential disputes. A credit lawyer acts as a trusted guide, providing expert advice and legal representation to ensure your rights are protected and your financial interests are safeguarded.

Whether you’re facing a debt collection issue, seeking to understand your credit rights, or negotiating a loan agreement, a credit lawyer can provide the necessary knowledge and expertise to navigate these complex situations effectively. From understanding the intricacies of credit law to advocating for your interests in legal proceedings, a credit lawyer can be an invaluable asset in safeguarding your financial well-being.

Understanding Credit Law

Credit law is a complex and ever-evolving area of law that governs the lending and borrowing of money. It impacts individuals and businesses in various ways, affecting their financial well-being and overall economic activity.

Types of Credit Law

Credit law encompasses various legal frameworks that regulate different aspects of lending and borrowing. These frameworks can be categorized into different types, each having its own impact on individuals and businesses.

- Consumer Credit Law: This area focuses on protecting consumers from unfair or abusive lending practices. It covers aspects like interest rates, loan terms, and disclosure requirements. It also provides consumers with certain rights, such as the right to dispute inaccurate credit information.

- Commercial Credit Law: This branch governs lending transactions between businesses. It includes laws related to commercial loans, lines of credit, and secured transactions. It also deals with issues like bankruptcy and insolvency.

- Mortgage Law: This area deals with loans secured by real estate. It covers aspects like mortgage origination, foreclosure, and loan modification. It also includes laws that protect borrowers from predatory lending practices.

Common Credit Law Violations

Violations of credit law can occur in various ways, and they can have significant consequences for both individuals and businesses. Common violations include:

- Unfair Debt Collection Practices: Debt collectors may engage in harassment, threats, or deceptive tactics to collect debts.

- Predatory Lending: This involves offering loans with excessively high interest rates, hidden fees, or deceptive terms.

- Credit Reporting Errors: Inaccurate or incomplete information on credit reports can damage a person’s credit score and make it difficult to obtain loans or credit.

- Identity Theft: This involves the unauthorized use of someone’s personal information to obtain credit or loans.

Legal Rights and Responsibilities

Credit law establishes a framework of legal rights and responsibilities for both creditors and debtors.

- Creditors have the right to collect debts owed to them, but they must adhere to legal procedures and ethical practices. They also have a responsibility to provide clear and accurate information about loan terms and conditions.

- Debtors have the right to fair treatment and transparency in their lending transactions. They also have the right to challenge inaccurate information on their credit reports and to seek legal remedies if their rights are violated.

When to Hire a Credit Lawyer

Navigating the complexities of credit law can be challenging, and there are situations where seeking professional legal advice is essential. A credit lawyer can provide invaluable support, protect your rights, and help you achieve the best possible outcome.

Examples of Credit Disputes That Require Professional Intervention

Credit disputes can arise in various forms, and some situations demand the expertise of a credit lawyer. Here are some examples of scenarios where seeking legal counsel is crucial:

- Debt Collection Lawsuits: If you are being sued by a debt collector, a credit lawyer can help you understand your rights, negotiate with the collector, and potentially defend yourself in court. They can also help you determine if the debt is valid and if the collection practices are legal.

- Credit Reporting Errors: If you discover inaccuracies or errors in your credit report, a credit lawyer can assist you in disputing these errors with the credit reporting agencies and help you restore your creditworthiness. They can also help you understand the process and the legal remedies available to you.

- Identity Theft: Victims of identity theft often need legal assistance to resolve the issues that arise from unauthorized use of their credit. A credit lawyer can help you file police reports, contact credit reporting agencies, and take legal action against the perpetrators.

- Bankruptcy: Filing for bankruptcy is a complex process that requires legal guidance. A credit lawyer can help you determine if bankruptcy is the right option for you, explain the different types of bankruptcy, and assist you in navigating the legal procedures.

- Foreclosure: If you are facing foreclosure on your home, a credit lawyer can help you understand your rights and explore options such as loan modification or bankruptcy. They can also represent you in court if necessary.

- Credit Card Disputes: If you have a dispute with a credit card company, such as unauthorized charges or billing errors, a credit lawyer can help you negotiate a resolution with the company or take legal action if necessary.

Benefits of Hiring a Credit Lawyer

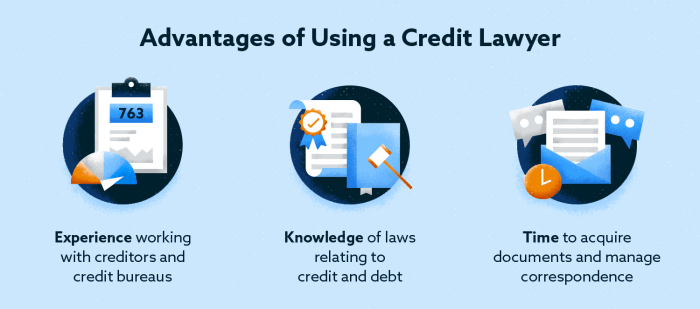

Having a credit lawyer on your side can provide numerous benefits, including:

- Expertise and Knowledge: Credit lawyers have specialized knowledge of credit laws and regulations, which can be complex and difficult to navigate on your own.

- Negotiation Skills: Credit lawyers are skilled negotiators who can advocate for your interests and help you reach a favorable outcome with creditors, debt collectors, or other parties involved.

- Legal Representation: Credit lawyers can represent you in court if necessary, protecting your rights and ensuring that your interests are represented fairly.

- Peace of Mind: Knowing that you have a legal professional on your side can provide peace of mind and reduce stress during a challenging situation.

- Protection of Your Rights: Credit lawyers can help you understand and exercise your legal rights under credit laws and regulations.

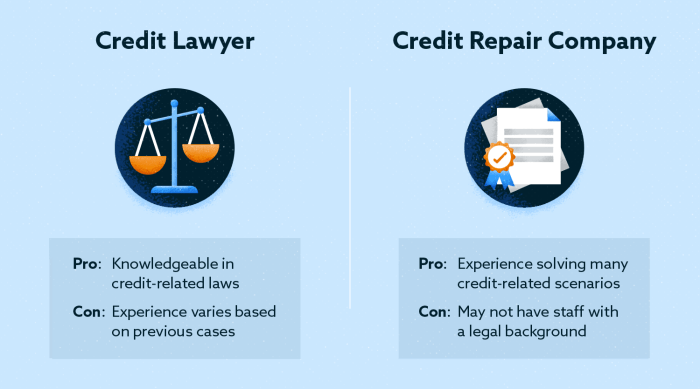

Finding the Right Credit Lawyer

Navigating the complex world of credit law can be daunting, especially when facing financial challenges. Seeking legal guidance from a qualified credit lawyer can provide invaluable support and potentially lead to positive outcomes. But how do you find the right lawyer for your specific needs? This section explores crucial factors to consider when choosing a credit lawyer, focusing on qualifications, research methods, and fee structures.

Qualifications and Experience

When selecting a credit lawyer, their qualifications and experience play a pivotal role in ensuring effective representation. Look for lawyers with a proven track record in handling credit-related legal matters, including:

- Expertise in consumer credit laws: A credit lawyer should have a deep understanding of federal and state laws governing consumer credit, such as the Fair Debt Collection Practices Act (FDCPA), the Fair Credit Reporting Act (FCRA), and the Truth in Lending Act (TILA). This expertise enables them to identify potential violations and build strong legal arguments on your behalf.

- Experience in debt negotiation and litigation: Credit lawyers often handle debt negotiation, helping clients reach favorable settlements with creditors. They should also be experienced in credit-related litigation, including debt collection lawsuits, credit reporting disputes, and bankruptcy proceedings.

- Knowledge of specific credit issues: Consider the lawyer’s experience in dealing with specific credit issues you may face, such as debt consolidation, credit card disputes, or medical debt.

Research and Finding Reputable Credit Law Professionals

Finding a reputable credit lawyer requires thorough research. Here are some effective strategies:

- Bar Association Referrals: Your state bar association can provide referrals to credit lawyers licensed in your area. They often have a directory of attorneys specializing in consumer credit law.

- Online Legal Directories: Websites like Avvo, FindLaw, and Justia offer comprehensive listings of attorneys, including their credentials, experience, and client reviews. These platforms can help you narrow down your search based on specific criteria.

- Professional Organizations: Look for credit lawyers who are members of professional organizations like the National Association of Consumer Bankruptcy Attorneys (NACBA) or the National Association of Consumer Advocates (NACA). Membership in such organizations often indicates a commitment to ethical practices and consumer advocacy.

- Word-of-Mouth and Recommendations: Seek recommendations from trusted sources, such as family, friends, or financial advisors who have experience with credit lawyers. Personal referrals can provide valuable insights into a lawyer’s reputation and effectiveness.

Fees and Payment Structure

Understanding the lawyer’s fees and payment structure is crucial before engaging their services.

- Hourly Rates: Many credit lawyers charge by the hour, with rates varying based on their experience and location. It’s essential to inquire about their hourly rate and any additional fees, such as travel expenses or court filing fees.

- Contingency Fees: Some credit lawyers work on a contingency fee basis, meaning they only get paid if they win your case. The fee is typically a percentage of the amount recovered. This arrangement can be beneficial for clients facing significant financial challenges, as they only pay if they receive a favorable outcome.

- Flat Fees: In some cases, credit lawyers may offer flat fees for specific services, such as debt negotiation or credit reporting disputes. This option provides upfront clarity on the total cost involved.

Credit Law Resources

Navigating the complex world of credit law can be daunting, but thankfully, there are numerous resources available to help you understand your rights and responsibilities. These resources provide valuable information on various aspects of credit law, from understanding your credit score to resolving disputes with creditors.

Government Websites and Consumer Protection Agencies, Credit lawyer

Government websites and consumer protection agencies are invaluable resources for obtaining accurate and reliable information on credit law. They provide comprehensive guides, regulations, and legal frameworks related to credit reporting, debt collection, and consumer protection.

- Federal Trade Commission (FTC): The FTC is a federal agency that protects consumers from unfair, deceptive, or fraudulent business practices. It offers information on credit reporting, debt collection, and identity theft. [https://www.ftc.gov/](https://www.ftc.gov/)

- Consumer Financial Protection Bureau (CFPB): The CFPB is a federal agency that protects consumers in the financial marketplace. It provides resources on credit cards, mortgages, student loans, and other financial products. [https://www.consumerfinance.gov/](https://www.consumerfinance.gov/)

- United States Department of Justice (DOJ): The DOJ enforces federal laws, including those related to consumer protection. It offers information on credit discrimination and debt collection practices. [https://www.justice.gov/](https://www.justice.gov/)

- Federal Communications Commission (FCC): The FCC regulates interstate and international communications, including telemarketing and debt collection calls. It provides information on how to avoid scams and report unwanted calls. [https://www.fcc.gov/](https://www.fcc.gov/)

Educational Materials and Guides

Numerous organizations and websites provide educational materials and guides on credit law, offering insights into consumer rights, debt management, and dispute resolution.

- National Foundation for Credit Counseling (NFCC): The NFCC is a non-profit organization that provides financial education and counseling services. It offers resources on credit management, debt consolidation, and bankruptcy. [https://www.nfcc.org/](https://www.nfcc.org/)

- Credit Karma: Credit Karma is a popular website that provides free credit scores and reports. It also offers educational resources on credit management, debt consolidation, and credit repair. [https://www.creditkarma.com/](https://www.creditkarma.com/)

- Experian: Experian is one of the three major credit reporting agencies. It provides information on credit reports, scores, and how to improve your credit. [https://www.experian.com/](https://www.experian.com/)

- TransUnion: TransUnion is another major credit reporting agency. It offers resources on credit reports, scores, and credit monitoring. [https://www.transunion.com/](https://www.transunion.com/)

- Equifax: Equifax is the third major credit reporting agency. It provides information on credit reports, scores, and credit monitoring. [https://www.equifax.com/](https://www.equifax.com/)

In conclusion, navigating the world of credit law can be a challenging journey, but with the guidance of a skilled credit lawyer, you can navigate these complexities with confidence. From understanding your legal rights to resolving disputes effectively, a credit lawyer empowers you to take control of your financial future. By seeking professional legal counsel, you can protect your interests, avoid costly mistakes, and navigate the intricacies of credit law with clarity and peace of mind.

Credit lawyers specialize in helping individuals and businesses navigate complex financial issues. While their focus is primarily on debt and credit, they can also be helpful in cases involving financial fraud. If you suspect financial wrongdoing within a company, you might want to consult with a whistleblower lawyer , who can advise you on your rights and options.

Credit lawyers, however, can help you recover from the financial consequences of such wrongdoing.